WE DON'T COAST.

We’re on a mission to makeOmaha a vibrant place

to do business, work and live. Join Today

We Mean Business.

Connecting the Business Community

Our 3,000+ member companies unlock opportunities to earn recognition, develop professionally and deepen their connection to the community.

Pursuing Economic Development

We work tirelessly to attract new investments and jobs to the region. When business expands and the workforce grows, we all win.

Advocating for Pro-Business Climate

We advocate for a strong business climate that fosters a thriving business community and a prosperous region.

We are all stronger together and the support of the Greater Omaha Chamber has been amazing. Strong, locally-based businesses are so vital to the health of a community’s economy and to keeping the best and brightest in the area. We are proud to be members of the Greater Omaha Chamber.

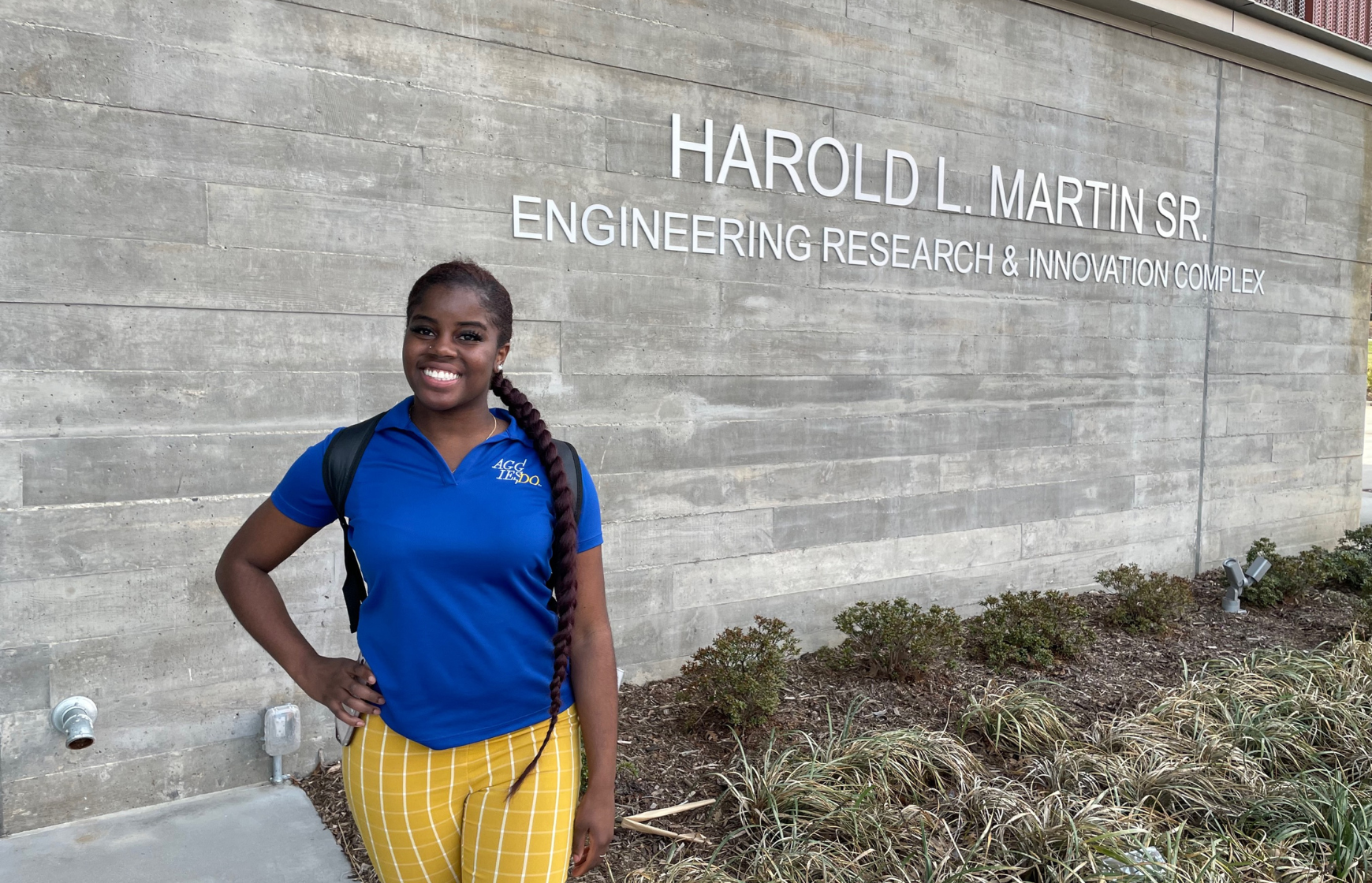

Growing Home

Growing Home is a mentorship program that helps students that identify as black, indigenous or a person of color (BIPOC) build a professional network, find internships and explore careers in Omaha while they earn their degrees. With the connections students make through this program, they will be well positioned to start a career here in Omaha. We are looking for scholars AND mentors.

Show Off Your Space

Interested in welcoming hundreds of local business professionals into your location? We host dozens of networking events each year, and we’re looking for venues and event sponsors for the 2023 season. Fill out the form below and get on the calendar.

When you look at the state of Nebraska, some of the economic policies and programs they have were certainly meaningful when it came to the overall evaluation of whether it made sense to locate this $600 million facility in Papillion, The Nebraska Department of Revenue was an excellent partner in helping us think through locating a site of this magnitude in a state like Nebraska and ultimately in the city of Papillion.

In the News

Upcoming Events

Networking Events & Leadership Series

We host 60+ networking events each year. That’s lots of chances for you to make professional connections with potential business partners or clients.

From the Blog

2024 YP Summit: A Future for Everyone

In the heart of Omaha, over 1,400 passionate young professionals converged for an extraordinary journey of discovery and transformation. Against the...

Status of the Session – April 9, 2024

The final days of the legislative session are always known for a few things: long agendas, late nights, frantic compromise discussions, and lots of...

April Business of the Month

Recently we had the privilege of sitting down with Doug Sorenson, Mark Sorenson and Carrie Ericson from Haney Shoe Store, a longstanding cornerstone...